Gold & Silver Morning Update 11/3/2025

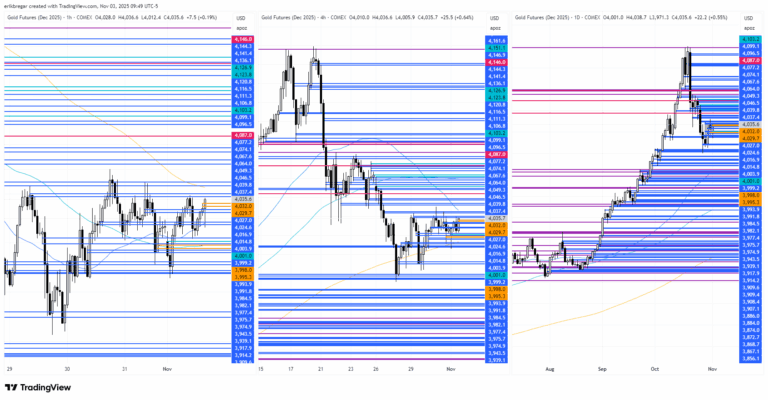

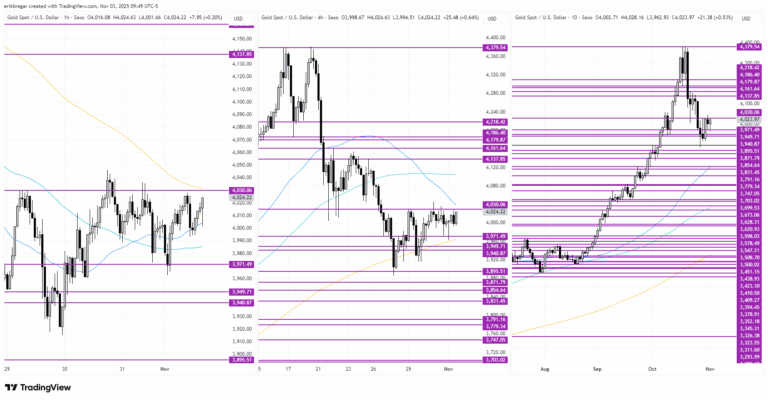

A challenging start to the week for the precious metals at the Globex open last night following a weekend Bloomberg report that said China had scrapped a tax break for gold retailers sourcing the metal from non-exchange sources, that will “likely increase the cost of buying gold for Chinese consumers”. A local gold expert on X pushed back though, saying this move merely shifts wholesale demand to the Shanghai Gold Exchange (that has VAT exemption), and so the more public exchange price of gold in China could actually go up because of this. Sure enough it did at the China open last night, with some help from USDCNH sales following another supportive CNY fix.

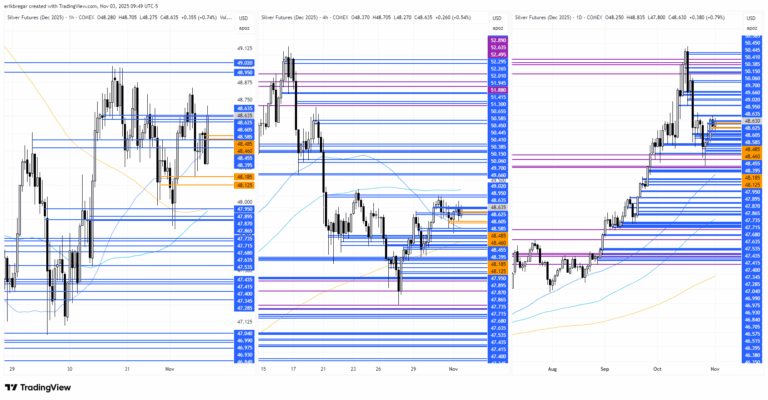

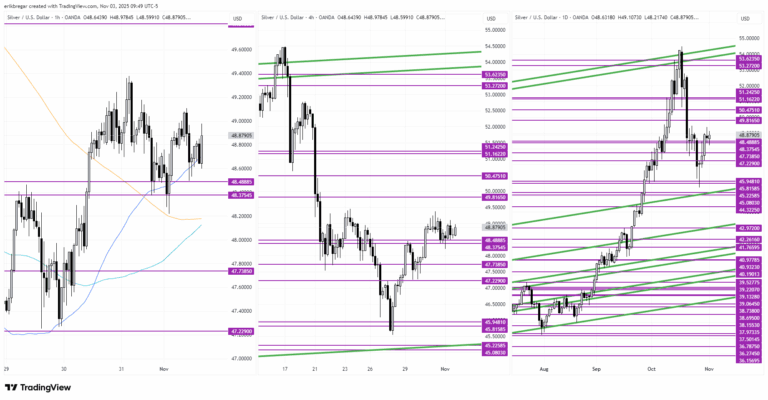

European sellers were back earlier this morning though, hitting all the precious metals when the broader USD began its breakout above Friday’s highs. Therre was no clear catalyst for this, but G7 bond yields did gap-up to the start the week. Algo selling at 9amET and the S&P cash open then knocked the metals lower again just a while ago, but thankfully for the bulls, both metals continue to defend their 55hr moving averages as new support, which were regained during that burst of Chinese buying last night. They’ll now want to see weaker-than-expected October ISM Manufacturing survey data on deck at 10amET.

This material is provided strictly for informational purposes and should not be construed as investment, legal, tax, or financial advice. Precious metals and other investments involve risk and may not be suitable for all investors. Past performance is not a guarantee of future results, and market conditions can change without notice. The information presented is believed to be reliable; however, no representation or warranty, express or implied, is made as to its accuracy, completeness, or timeliness. No liability will be accepted for any loss or damages arising from the use of, or reliance on, this material. This publication does not constitute an offer, solicitation, or recommendation to buy or sell any product, security, or investment strategy. Readers should consult with independent financial, legal, tax, and other professional advisors before making investment decisions. All product names, trademarks, and company names mentioned are the property of their respective owners. Reference to them does not imply endorsement.