Gold & Silver Morning Update 10/22/2025

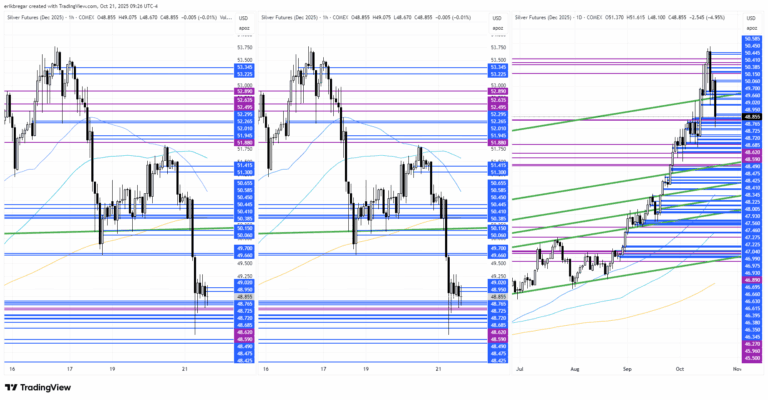

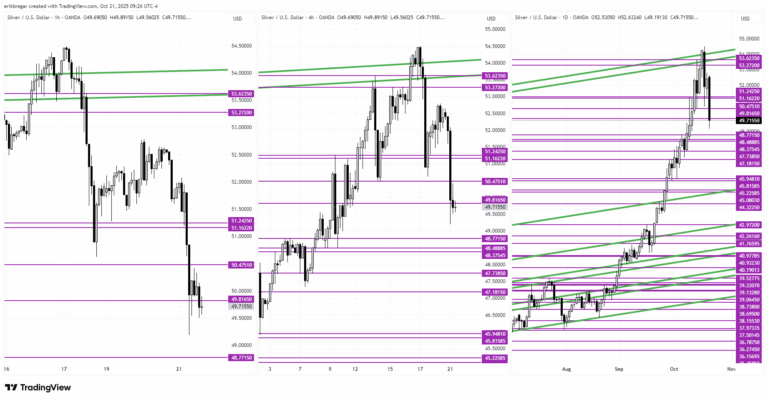

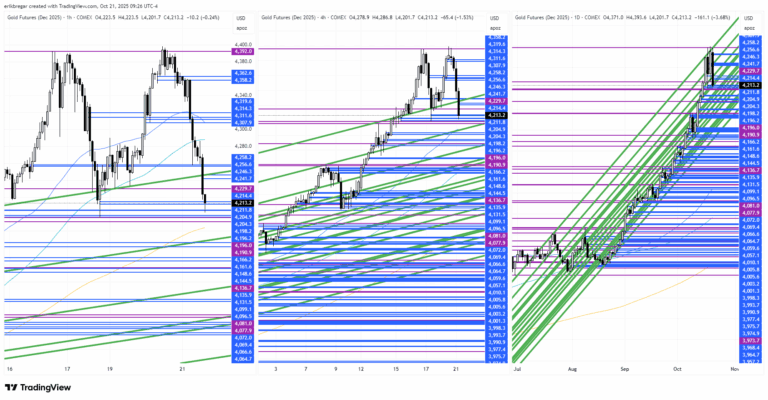

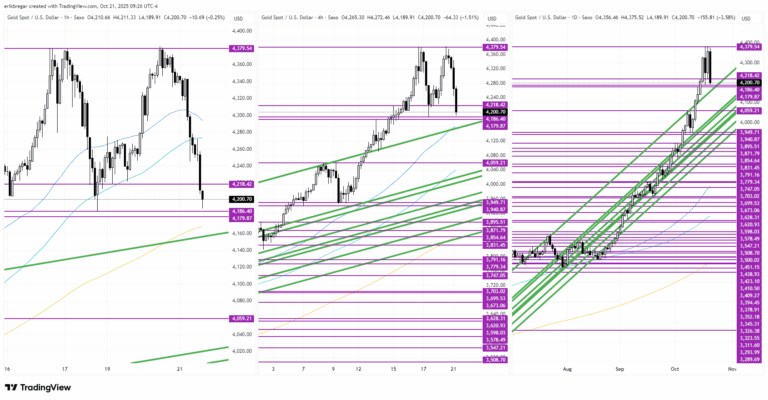

A brutal last 24hrs for the precious metal bulls. Platinum’s sudden collapse below its Oct 2 low at 9:42amET obliterated bottoming attempts from gold & silver dip buyers at the S&P cash open yesterday, and gold’s loss of Friday’s lows & its 200hr moving average over the next half hour unleashed a tumultuous plunge into last Monday’s COMEX opening range. Yesterday’s comfortable NY closing prints above the COMEX closing ranges offered some hope for a precious metal bounce overnight, but this got destroyed by a violent -$120 (-2.8%) sell-stop attack in the December gold futures (smacking prices down into last week’s open) at the Asian open last night. Makes you wonder if Chinese accounts were behind this hit because gold magically rebounded when local spot markets opened an hour later. Things were looking good again going into the European open, with all the precious metals trading back above their Globex opens, but we then saw another ferocious 3-5amET slam come in, similar to the day before (if you believe there’s now a physical metal war going on between the US and BRICS, this almost feels like some European bullion banks are now trying to fight back with LBMA paper sales).

Early NY trade had a “enough’s enough” feel to it, with what felt like heavy Western algo buying at 9amET propelling breaks above this morning’s COMEX opening ranges for all the metals, but new session highs for the US 10yr yield (after this morning’s defense of Friday’s lows) is now slowly chipping away at that enthusiasm. I think the best the precious metal bulls can hope for today is some stock market weakness than softens US yields a bit, so that gold & silver don’t completely give up this morning’s bounce.

This material is provided strictly for informational purposes and should not be construed as investment, legal, tax, or financial advice. Precious metals and other investments involve risk and may not be suitable for all investors. Past performance is not a guarantee of future results, and market conditions can change without notice. The information presented is believed to be reliable; however, no representation or warranty, express or implied, is made as to its accuracy, completeness, or timeliness. No liability will be accepted for any loss or damages arising from the use of, or reliance on, this material. This publication does not constitute an offer, solicitation, or recommendation to buy or sell any product, security, or investment strategy. Readers should consult with independent financial, legal, tax, and other professional advisors before making investment decisions. All product names, trademarks, and company names mentioned are the property of their respective owners. Reference to them does not imply endorsement.